How To Get To Springer Mountain And Home From Katahdin For (Almost) Free

This article is going to tell you how to get to the start of your thru-hike and home again for almost free by “travel hacking.” More specifically, I will explain how to use airline reward programs to fly to or from Atlanta, Ga., and to or from Bangor, Maine, and pay only $11.20. Even more precisely, I will show you how to leverage frequent flyer miles to not only cover the cost of the flight to and from the beginning and end of your hike, but also for another round-trip journey anywhere in the U.S. – all by signing up for one credit card and maximizing its rewards.

Who This Is For

Despite the name travel hacking, following the strategy I outline below does not require illegal activity, special computer skills, sketchy behavior, or a pyramid scheme. It simply depends on a person with good credit and robust organizational skills to maximize a rewards program. It works perfectly for those with a high credit score and the ability to pay off their balances each month. Please, please, please do not attempt to sign up for multiple credit cards just to get the rewards without having the means to pay them off and act responsibly.

Before we get in too deep, let’s start with some definitions.

Frequent Flyer Programs

Nearly all airlines have their own frequent flyer rewards programs. For example, United Airlines has the MileagePlus program and American Airlines has the AAdvantage program. Each of these programs has its own frequent flyer miles, which are earned by flying on their flights, having an associated credit card that provides miles based on how much you spend, or various other promotions. You cannot use miles from one program on any other program except when they are in the same alliance. The major alliances are SkyTeam, Oneworld, and Star Alliance. For example, United miles cannot be used on American flights because they are different programs and not in an alliance. However, United miles can be used to book Lufthansa flights because both airlines are in the Star Alliance.

For more information and to see which airlines belong to the respective alliances, see this article.

Transferable Points And Currencies

Here’s where it can get confusing.

In addition to airline frequent flyer miles, there are also credit cards that accumulate their own proprietary points, which are earned through bonuses given to new applicants as well as for spending. Depending on the type of points, most are transferable to a variety of different airline or hotel reward programs regardless of their alliance. There are three main types of transferable currencies, which are issued from separate banks. They are Chase Ultimate Rewards Points (UR), Citi ThankYou Points (TYP), and American Express Membership Rewards Points (MR).

Each of these currencies has different airline or hotel partners they can transfer to, which do not necessarily overlap (but sometimes they do). For example, Chase Ultimate Rewards Points can transfer to United MileagePlus at a 1:1 ratio (1 UR = 1 United mile), but neither Citi TYP or Amex MR points can transfer to United. Here is a good blog post that lists the different programs that each currency can transfer to. Note that this does not work the other way around – under no circumstance can you transfer a frequent flyer mile into a UR, TY, or MR point.

Nuts And Bolts

Get ready to drink through the fire hose. I’m going to explain the travel hacking process very broadly and simply in three steps.

Step 1: Earn transferable points, which will enable you to book flights for (almost) free.

The fastest and easiest way to do this is to open credit card(s) that offer lucrative signup bonuses for new applicants after meeting a minimum spending requirement.

While each of the aforementioned transferable currencies (UR, TYP, and MR) have their own pros and cons, the strategy I will explain utilizes Chase Ultimate Rewards exclusively. There are several ways to earn Ultimate Rewards points, and this this blog post explains the different credit cards offered by Chase Bank to do so.

My recommendation for anyone starting fresh is to apply for the Chase Sapphire Preferred card.

This card offers the following benefits:

- 50,000 Ultimate Rewards points after spending $4,000 within three months (enough for two round-trip flights within the U.S.).

- 2x Ultimate Rewards points per $1 spent on travel and dining purchases.

- No foreign transaction fees

- The $95 annual fee is waived for the first year.

I recommend this card for several reasons:

- It has a nice signup bonus with an easy-to-meet minimum spending requirement (some people spend that much in a month on just gear).

- It has the ability to transfer UR points to airlines (note: not all Chase cards that earn Ultimate Rewards Points provide the ability to do this).

- The annual fee is lower than the premium cards (usually $450) and is waived for the first year. This means that they don’t charge you until the second year, but you get all the benefits up front (Don’t want to pay the fee? Cancel the card after the first year).

- It offers other great benefits such as rental car insurance, trip delay insurance, and purchase protection.

Step 2: Use the earned points to book flights either by transferring them to a frequent flyer program or booking through a site that lets you buy flights with points (more on this below).

This blog post explains the exact process of linking a United MileagePlus frequent flyer account to your Ultimate Rewards account, transferring points, and searching for flights. It’s a great reference and something you may need to go back to multiple times. The process of linking other frequent flyer accounts is identical, and most transfer at a 1:1 ratio (1 UR point = 1 mile).

In addition to having the ability to transfer your Chase UR points to a number of airlines, having the Sapphire Preferred card also gives you access to Chase’s Ultimate Rewards Travel Portal. There, you can search for whatever flight you want from this site and have the option to pay for it using your UR points instead of cash at the rate of 1.25 cents per point. This is easier than transferring your miles to an airline because you simply search as you would on Kayak or Skyscanner (except on the portal instead of those sites), and see exactly the same flights and how many miles it would cost you to book them. Here’s a blog post that explains how to navigate and search on the Ultimate Rewards portal.

The advantageous part of the Ultimate Rewards travel portal is that you have far more options to book from than if you were transferring to an airline partner. When transferring to a partner you’re restricted to only the airlines and hotels that Chase has a relationship with, but when you’re using the Ultimate Rewards travel portal, you are searching all available flights, regardless of the carrier. This can yield different, and sometimes more optimal, results. In my experience, the Ultimate Rewards travel portal is a better value for cheaper domestic U.S. routes whereas transferring to airline partners is a better value for international flights. YMMV.

Step 3: Enjoy your free flight!

Sit back, count the dollars you saved, and smirk at all the others on your flight who probably paid cash for their trip. Suckers!

Real-Life Example

Now that we’ve established what travel hacking is, how transferable currencies work, which credit card you should sign up for, and how to go about searching for and booking your almost-free flight, I’ll show you exactly why it is advantageous to go this route instead of paying out of pocket.

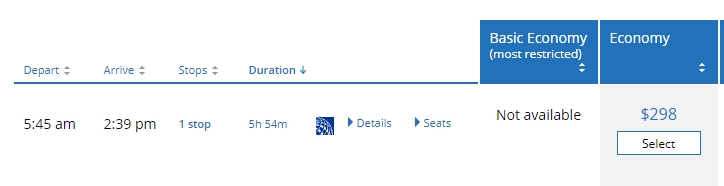

The best way to illustrate the power of using points and miles is by example, so let’s say that I live in Los Angeles (I don’t) and am hiking NOBO on the AT starting on March 14, 2018, and finishing Sept. 12. Having a healthy stash of UR Points from my Sapphire Preferred card signup bonus, I go to United.com and search for flights from Los Angeles to Atlanta, and here is what I see:

The shortest duration one-way flight costs $298. Day-um. Now I choose to search for award flights, and here is what comes up:

12,500 miles plus $5.60 – that’s more like it!

Similarly, I look at paid flights returning to Los Angeles from Bangor in September:

Also $298. What kind of a scam is this?! Screw that, let’s see how many miles it costs:

Once again, 12,500 miles plus $5.60! Here’s the pattern you may have picked up on: United charges 12,500 miles plus $5.60 (taxes and fees) for any one-way trip within the United States at the “Saver” level. Obviously there are some days when this rate is not available and they charge double the miles, but for a vast majority of the time this lower rate is an option.

So if in this example I paid cash for the flights, I’d be out $596. By transferring Chase Ultimate Rewards points to United miles, I would pay 25,000 miles plus $11.20 – a savings of $585! What’s more, I’d have 25,000 UR points leftover to take another round-trip flight anywhere in the U.S. for the same price.

How blown is your mind right now? But wait, there’s more. Just to cover my bases, I would also check the Ultimate Rewards travel portal to see if there are any good deals to be found. If I were to search for that same United flight on the portal, here is what I would find:

The exact same flight as above would cost 18,240 UR points instead of the 12,500 United miles quoted above. In this instance, you’d be better off transferring to United rather than using the portal.

The exact same flight as above would cost 18,240 UR points instead of the 12,500 United miles quoted above. In this instance, you’d be better off transferring to United rather than using the portal.

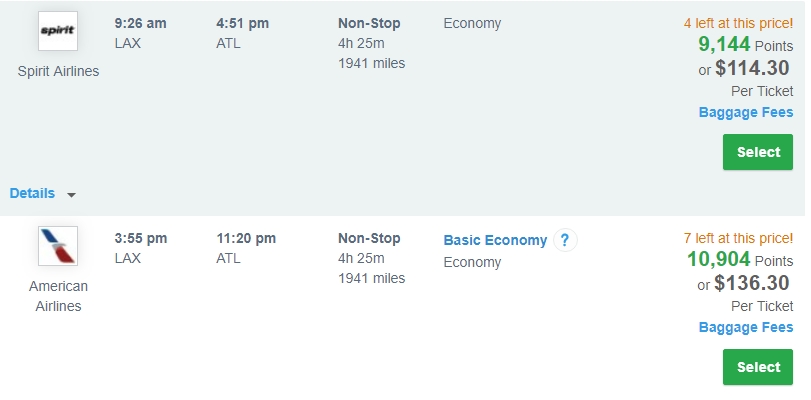

However, as explained above, the advantageous part of the Ultimate Rewards travel portal is that you are not bound to a particular airline. So, if I didn’t care about which airline I flew to get me from Los Angeles to Atlanta, I could simply plug in the dates and get the following:

This result indicates that I could fly on Spirit (shudder) or American Airlines for fewer UR points than it would cost flying on United if I transferred points. Because neither Spirit nor American Airlines are transfer partners of Chase UR points, going through the Ultimate Rewards travel portal is the only way to use points on these particular flights. In this instance, the travel portal is a better deal. It’s always good to check the Ultimate Rewards portal before transferring points.

This result indicates that I could fly on Spirit (shudder) or American Airlines for fewer UR points than it would cost flying on United if I transferred points. Because neither Spirit nor American Airlines are transfer partners of Chase UR points, going through the Ultimate Rewards travel portal is the only way to use points on these particular flights. In this instance, the travel portal is a better deal. It’s always good to check the Ultimate Rewards portal before transferring points.

Summary: To Springer And Home From Katahdin For (Almost) Free

To keep things simple, here are the step-by-step instructions for booking nearly free flights:

- Apply for the Chase Sapphire Preferred card. Get approved because you rock.

- Meet the $4,000 minimum spending requirement by charging all your expenses on the card and/or prepaying bills like rent, cell phone, and insurance.

- Once the 50,000 UR points post to your account, follow the directions here to link your UR account to your United MileagePlus/other airline account and search for flights.

- Compare the available flights to those on the Ultimate Rewards Travel Portal and see which is the better deal. If the travel portal is better, book it!

- If it’s more advantageous to book through United, transfer UR points to your United account (only when you’ve found a flight and know how many miles you need – remember, transfers are one-way and cannot be undone).

- Book your flight on United.com.

- Take a hike!

Wrap-Up

In this manifesto-like post, I’ve attempted to spell out the process of leveraging transferable credit card points and frequent flyer programs to get free flights. The process is as simple as signing up for one credit card, charging your spending to it, and either booking a flight through the Ultimate Rewards travel portal or transferring the points to an airline partner and booking through their system. The example given was how to get to or from Atlanta and Bangor for a thru-hike, but it works for any destination in the U.S., so don’t rule out all the other possibilities.

While it’s certainly feasible to do a one-and-done credit card application, some of you will want to take things to the next level. This post just scratches the surface. The opportunities that travel hacking provides can far exceed your wildest travel dreams and help you realize trips and adventures you never thought possible. For example, in early 2017 my girlfriend and I flew around the world in first and business class, stopping in multiple parts of Asia along the way. We spent a total of 325,000 points and miles and only $2,300 out of pocket for a trip that would have cost $35,000 had we paid cash. While I’m pretty proud of that trip, I’m still a small fish compared to the ballers who make their living on travel hacking.

Either way, if you’re interested in continuing to learn about award travel, a great place to start is the Award Travel 101 Facebook Group. There, you’ll be in good company with newbies and elites alike who are sharing tips, answering questions, and providing additional resources.

Feel free to ask any questions below. Hope to see you on Springer Mountain with a full wallet!

This website contains affiliate links, which means The Trek may receive a percentage of any product or service you purchase using the links in the articles or advertisements. The buyer pays the same price as they would otherwise, and your purchase helps to support The Trek's ongoing goal to serve you quality backpacking advice and information. Thanks for your support!

To learn more, please visit the About This Site page.